Boothbay's tax rate increases

When Boothbay taxpayers opened their mail recently, they might have discovered some alarming news: the property tax rate went up 9.5 percent to $8.40 per $1,000 of assessed value.

For the past five years, Boothbay's tax rate has remained at $7.67 per $1,000 of assessed valuation. But with decreases in state revenues, coupled with a dip in property value growth, the tax rate increase is largely beyond the control of local government, Boothbay Town Manager Jim Chaousis said.

“The natural tendency of the taxpayer is to blame the town for an increase in taxes,” Chaousis said, “but the explanation is much more intricate.”

In a two-page memo, Chaousis explained the tax rate increase before the Boothbay Board of Selectmen on June 24.

Maine law specifies there can only be three distribution categories listed on the property tax bill: to the town of Boothbay, Lincoln County and public education.

“What people don't see is the town of Boothbay portion breaks up into further distribution,” Chaousis said.

If the state law allowed for full disclosure on the tax bill, Chaousis said the distribution would look like this:

-64 percent to the school

-13 percent to town of Boothbay services (roughly $1.9 million)

-13 percent to Lincoln County

-4 percent to the Refuse district

-3 percent to overlay- (amount of money appropriated above the expenditures and revenues)

-2 percent to Ambulance/Library/Cemetery, etc.

In the past year, Lincoln County and education costs went up 2.4 and 2.8 percent respectively, but local expenditures increased by less than 1 percent.

“If you look at just expenditures, the town appropriations include the operating budget, the refuse district, the ambulance service; all of those things have actually over the entire five years, only grown 3.9 percent, which is less than one percent increase per year,” Chaousis said. “It's not based on extra spending.”

Boothbay's operating budget has decreased in the past three years; the fiscal year 2014 operating budget was set at $1,923,376, compared to the $1,934,108 Boothbay spent in 2010, meaning the town has reduced its budget by $10,732.

“The knee-jerk reaction is to go cut services because of the horrible spending habits of your local government, and I'm here to say that our local government's spending habits are right on for the past five years,” Chaousis said.

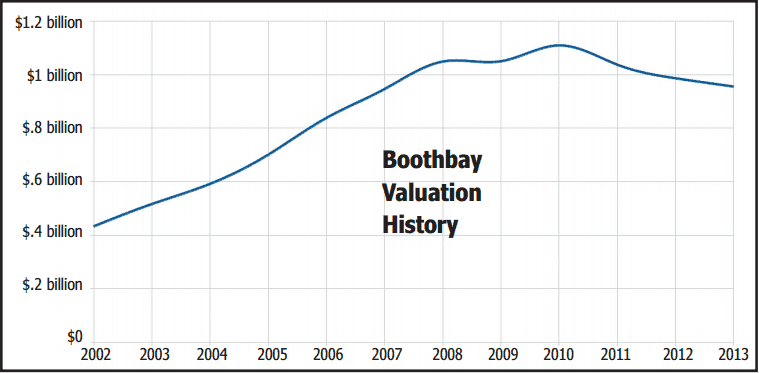

Since 2002, the town of Boothbay was able to avoid tax increases by relying on incremental growth of total property value, as indicated by the state valuation each year, but since 2007, property growth in Boothbay has slowed down tremendously, Chaousis said. (See graph for details.)

With the recent passage of Maine's biennial budget, state revenues have decreased by 29.4 percent, and tax refunds like the “circuit breaker” program were replaced with the Property Tax Fairness program.

Instead of receiving a refund calculated by gross income and property value, eligible Maine residents will get $300 back from the state.

Despite being on the state's chopping block during the budget sessions, the existing homestead exemption, which gives tax breaks of up to $10,000 off the total assessed property value, will remain.

Event Date

Address

United States