Boothbay unveils master plan

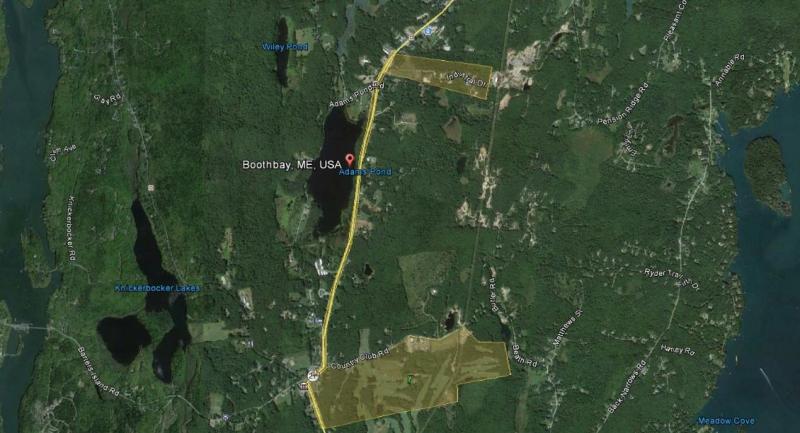

A drawing representing the proposed Boothbay Village and Industrial Park TIF district consisting of the golf course, the Boothbay common and the properties running north along the Route 27 corridor, including Boothbay's industrial park. Courtesy of Jim Chaousis, Google Earth

A drawing representing the proposed Boothbay Village and Industrial Park TIF district consisting of the golf course, the Boothbay common and the properties running north along the Route 27 corridor, including Boothbay's industrial park. Courtesy of Jim Chaousis, Google Earth

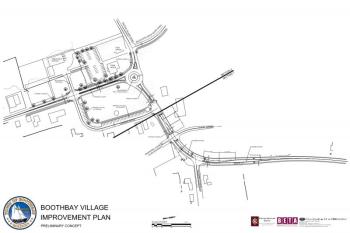

A preliminary concept drawing of the Boothbay village common improvement plan is on display at the Boothbay Town Office. Courtesy of Jim Chaousis and Knickerbocker Group

A preliminary concept drawing of the Boothbay village common improvement plan is on display at the Boothbay Town Office. Courtesy of Jim Chaousis and Knickerbocker Group

A drawing representing the proposed Boothbay Village and Industrial Park TIF district consisting of the golf course, the Boothbay common and the properties running north along the Route 27 corridor, including Boothbay's industrial park. Courtesy of Jim Chaousis, Google Earth

A drawing representing the proposed Boothbay Village and Industrial Park TIF district consisting of the golf course, the Boothbay common and the properties running north along the Route 27 corridor, including Boothbay's industrial park. Courtesy of Jim Chaousis, Google Earth

A preliminary concept drawing of the Boothbay village common improvement plan is on display at the Boothbay Town Office. Courtesy of Jim Chaousis and Knickerbocker Group

A preliminary concept drawing of the Boothbay village common improvement plan is on display at the Boothbay Town Office. Courtesy of Jim Chaousis and Knickerbocker Group

The Boothbay Board of Selectmen has unveiled a plan that they said could bring significant economic growth to the region for the next 30 years.

The Boothbay Harbor Country Club has teamed up with the town to develop a tax incremental financing district (TIF) estimated to generate more than $4.5 million in tax revenues, as long as voters approve the referendum question on November 5.

The proposed district would be called the Boothbay Village and Industrial Park TIF. It would comprise 272 acres of land consisting of the golf course, the Boothbay Common and the properties running north along the Route 27 corridor, including Boothbay's industrial park.

The idea developed out of executive sessions with the Boothbay town administrators, the Knickerbocker Group and an attorney representing Paul Coulombe, the owner of the country club.

“We found out the country club was going to do a major development and we immediately recognized that there was going to be an increase in the value of the property,” Town Manager Jim Chaousis said. “We’re asking the town to create a tax increment financing district, and we’re asking the town to take out a $2.5 million dollar bond, which will then be paid for by the tax increment finance district.”

During the September 11 board of selectmen meeting, Chaousis explained Coulombe's investment in the country club would increase the assessed value of the TIF district by as much as $8 million.

Anticipating the increase in property taxes, the TIF district would freeze the original assessed property value of the district, adding revenue generated by new development into a separate fund called “captured value.” Property taxes generated by the captured value would support further development in the district.

According to Chaousis, nearly $180,000 would be generated annually in new tax revenue, which could amount to $4.7 million dollars throughout the 30-year term.

The most important draw to the town of Boothbay, according to Chaousis, is that the TIF revenue would cover 100 percent of the bond; and bring in an estimated $1.2 million that could help pay for major public infrastructure projects.

The TIF district could provide funding for the town's long-term goals of improving transportation, public safety and building water and sewer lines to serve Boothbay's commercial districts.

“All of these funds can be used in imaginative ways to do more economic development within the town,” Chaousis said, as he presented a preliminary drawing of the Boothbay Common. The drawing detailed medians, revamped parking spaces, turning lanes and a rotary around the war monument.

Should the $100 million dollar state bond issue pass on November 5, Boothbay will be more likely to secure additional funds from the state. However, voters must approve Articles 2 and 3 on the local referendum authorizing the creation of the TIF district and the borrowing of up to $2.5 million.

Chaousis said the TIF district would stimulate the private sector, attract new businesses and create jobs, sheltering the economy against adverse adjustments to state subsidies and county taxes based in total valuation.

“TIFS are one of the only economic development tools the towns and cities have,” said Eric Conrad, director of communications at the Maine Municipal Association.

“Other than having a good business climate and being business-friendly, it's one of the few things towns can do to draw business in, so it's not like there's a lot of other options out there for a town like Boothbay.”

In Maine, TIFs have been used to promote economic development for 36 years. In 1993 a law passed allowing credit enhancement agreements (CEAs).

CEAs, sometimes referred to as a “kickback” in taxes, permit the newly generated property tax dollars to be channeled back to the developing business, at the discretion of the town.

In Boothbay's case, the selectmen have reserved the right to offer a CEA as a future incentive to recruit businesses to the TIF district, if they so choose.

Boothbay currently has two existing TIF districts at Washburn & Doughty and Hodgdon Yachts shipyards.

Throughout the state there are about 350 active TIF districts, according to the Department of Economic and Community Development. The DECD receives about 48-50 applications per year from municipalities, and two-thirds of the TIF applications are amendments to existing districts.

“In a TIF district the question is: what is the benefit of the tax break versus the community impact?

“If those things are well thought out, and knowing Boothbay they will be, a TIF is often a pretty good case to make,” Conrad sai

The Boothbay Village and Industrial Park TIF received unanimous support from the selectmen.

“We’ve been handed the perfect case scenario for us,” said selectman’s chairman Steve Lewis. “We’ve got the opportunity to do all of this at zero cost to us.”

Chaousis and the board of selectmen encouraged the public to stop by the Boothbay town office to learn more about the proposed TIF district, and to ask as many questions as they can between now and the November 5 referendum.

Event Date

Address

United States